Property tax means the annual sum of money that a landowner, building owner must pay to the local government or the municipal corporation of his/her area. It is the primary source of income for the Tamil Nadu government. The property includes all tangible real estate property, his house, office building, and the property he/she has rented out to others.

What documents are required for Registration?

The documents must be submitted for verification to the Revenue Commissioner investigating the case. After verification, it will take 15 to 30 days to register the property.

- Last tax payment receipt

- No Objection Certificate (NOC) via the housing society

- Attested copy of sale transaction deed/sale deed with individual’s name on it

- Duly signed and filled out.

Which areas need to pay Property Tax Rates Across Tamil Nadu?

- Opulent areas with all the basic amenities.

- Opulent areas with just one or two basic amenities.

- Mid-income areas with / without amenities of every basic.

- Short-income areas with / without every basic amenity.

What is the percentage of tax on property in Trichy?

| Property type | Zone | New tax value (Rs/Sq ft) | Increment for existing properties |

| Residential | A | Rs. 2 | 50 % increase |

| Residential | B | Rs. 1.80 | 50 % increase |

| Residential | C | Rs. 1.50 | 50 % increase |

| Commercial | – | Varies | 100 % increase |

Who Collects Property Tax in Trichy?

- Property owners in Trichy should pay the property tax twice a year. The money collected by the Tiruchirappalli City Municipal Corporation (TCMC) is used in managing the civic amenities in the city.

What will be the penalty, if you fail to pay the Property Tax?

- Failure to make a timely payment will result in a penalty of 1% per month.

When is the due date for paying Property tax?

- April 30

How is Property Tax in Trichy calculated?

Property taxes are calculated based on the property’s Annual Rental Value (AVR) and Budget Variance Report (BVR). Check out the below-mentioned formula for Tamil Nadu property tax calculation:

- Total AVR = AVR of covered space + AVR of uncovered space.

- AVR of uncovered space = 12 x (½) x BVR x uncovered area in square foot.

- Area of the covered space can be defined by the multiplication of the relatable value, including the addition of 12.

- Property tax of an apartment building / flat is calculated based on the basement floor area.

- The rate varies depending on the location of the property.

- The usage of the property helps in calculation too, as tax rates for residential and commercial properties differ.

- The occupancy type and total period of the building existence are additional factors for the tax calculation.

How to pay Property Tax offline?

- Identify the zone and the ward where your property falls.

- Fill in details in the property tax form and submit.

- Proceed to make payment with card, cash, or cheque.

- You’ll receive an acknowledgement receipt.

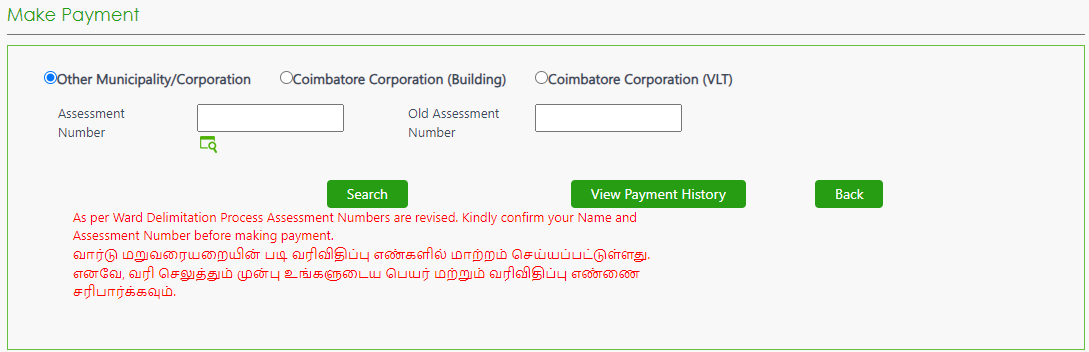

- Visit tnurbanepay.tn.gov.in

- To create an ID to login, Click “New User Registration”.

- If you’ve already registered, please enter – Mobile Number, Password, Captcha Code — Click “Login”.

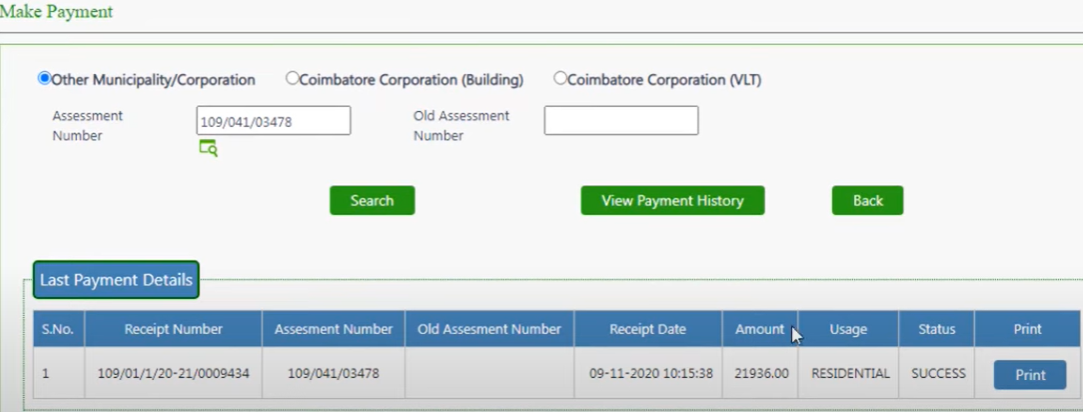

- Enter the Assessment Number, your last payment details will displayed and can download to take print.

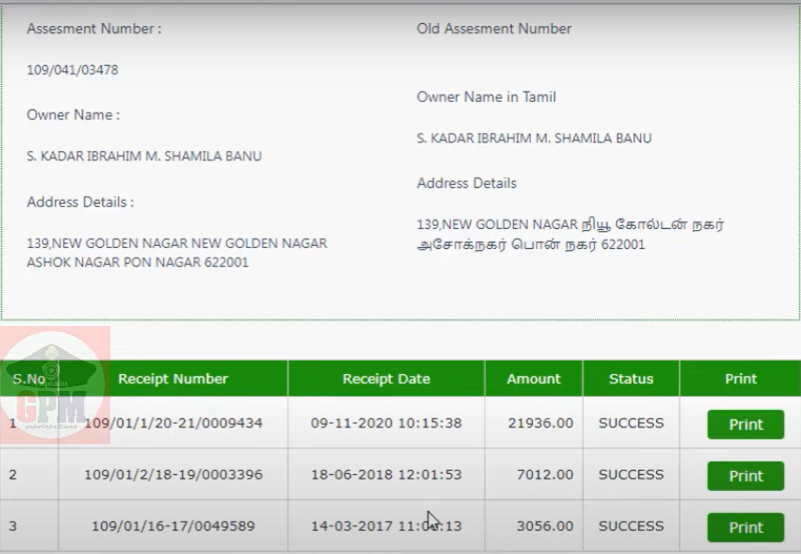

- You can also choose “View Payment History” check the full payment details.

- The property tax will depends upon the land and areas.

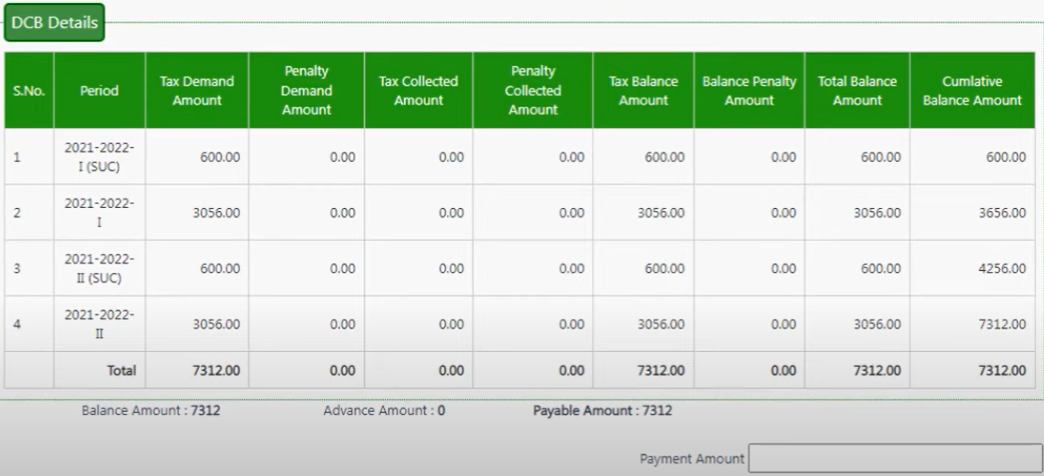

- Scroll down to view – Assessee & Property Tax balance list details.

- Pay the balance amount and click ‘Submit’.

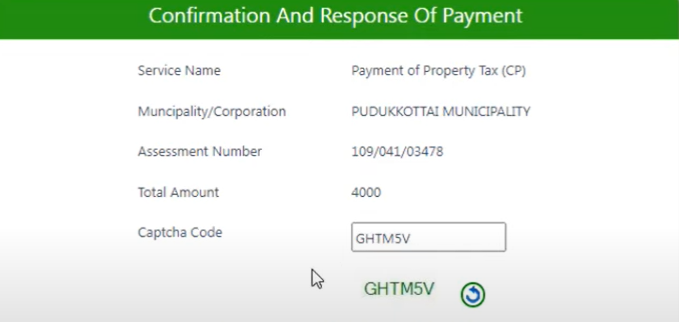

- Your payment details will appear.

- Enter the ‘Captcha and submit’ (Important: Read the Terms & conditions).

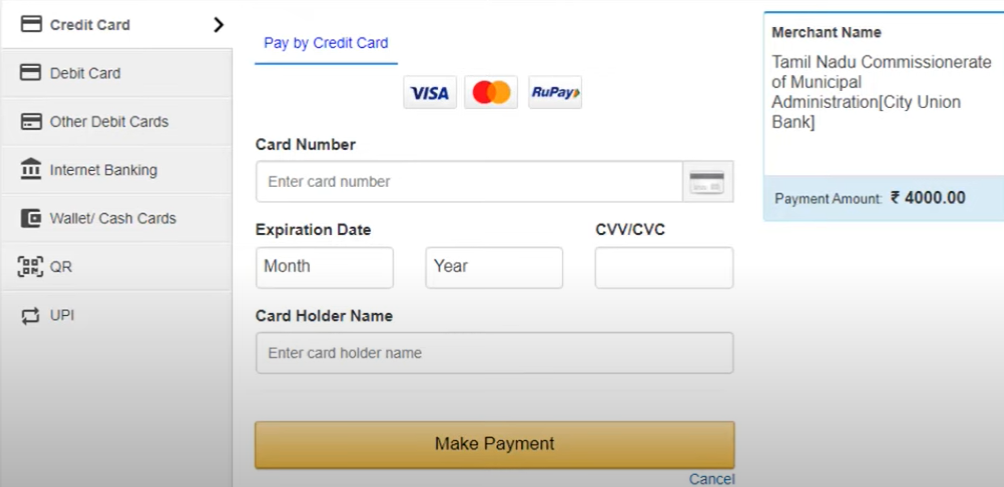

- Enter your Credit Card Number, Card Holder Name & Expiry Date.

- You can make payments through Credit / Debit Card, Other Debit Cards, Internet Banking, Wallet/ Cash Cards, Scan by QR (or) UPI.

Property Tax – Last Payment Details

Property Tax – Last Payment Details

View Property Tax Payment List

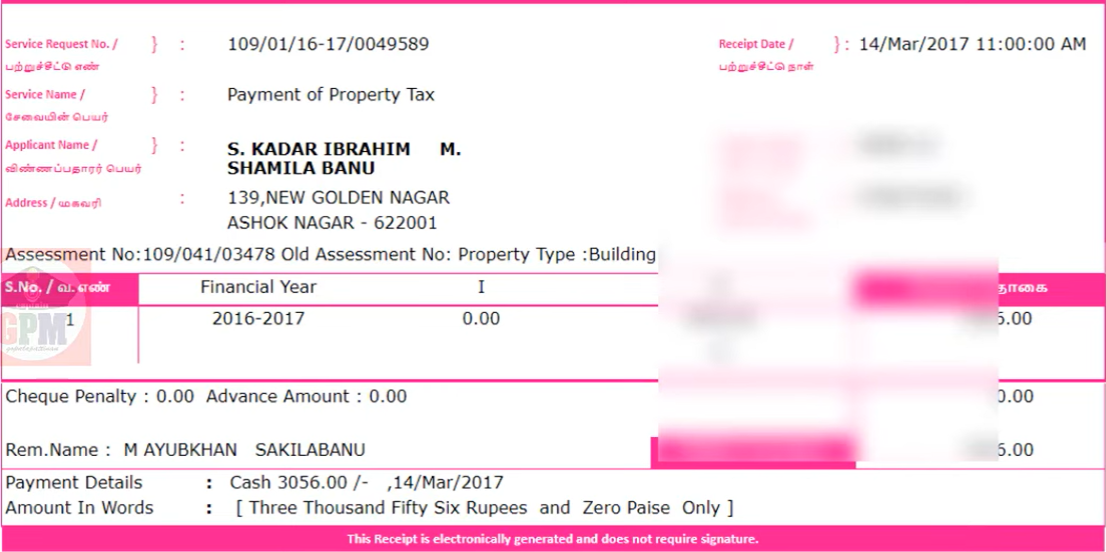

Property Tax Payment Receipt

Property Tax balance list

Confirmation of Property Tax Payment

Property Tax Payment method

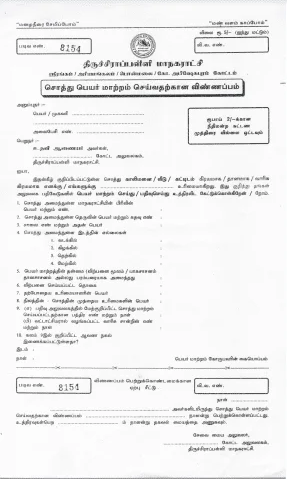

How to change name in Property Tax, Trichy?

Choose if your land/property in Corporation, Municipality, Village panchayat and produce the following documents,

- Deed (Kiraiya/Settlement/Dhana pathiram)

- Parent Documents (Moola Pathiram)

- Owner Aadhar card

- Owner Photo

- Old property tax & Water tax receipt

- Drainage (UGD) receipt

- EC/Villangam Certificate – 1 year

- Promissory note (Uruthimozhi pathiram) with Rs.20 Stamped paper

How to apply?

- Go to https://tnurbanepay.tn.gov.in/

- Download the form and complete it by providing all the required details.

- Fill out and attach with the required documents

- Duly with Rs.20 Stamped paper

- Submit the filled form to the nearest municipality office.

- You’ll receive an acknowledgement

- After processing, information will be sent through postal.

What are the property tax rules in Tamil Nadu?

| Type of area | Minimum Rate | Maximum Rate |

| Municipalities | 15% | 35% |

| Corporation | 20% | 40% |

| Town Panchayats | 15% | 30% |

For any queries, please contact

Tollfree No.: 1800-102-1994

Landline (Extn): 0431-2415396(114)

WhatsApp: 8300113000

Contact Trichy corporation office Social media